IBM and Microsoft reported earnings last week and the reports clearly highlighted the current stage in the transformation of each companies. Arguably the two most important software companies of the last 40 years, Microsoft and IBM used to exhibit similar patterns in the earnings reports a few years ago. However, those days are long gone.

Microsoft and IBM are companies in the middle of aggressive transformations to adapt their business models to a world dominated by technology revolutions in areas such as mobile, cloud, data science, augmented reality etc. The earnings reports clearly illustrates the effectiveness of the transformation process in each company contrasting the grow in new strategic areas with the decline of traditional business.

Microsoft: Growth in the Right Areas

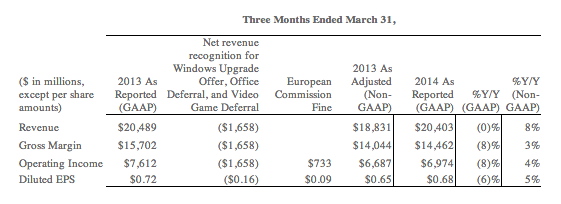

Microsoft’s earnings reports can be summarized in a single sentence: “Growth in the right areas”. The Redmond giant reported remarkable growth in areas such as cloud, devices that compensate the decline in traditional areas such as Windows and Office.

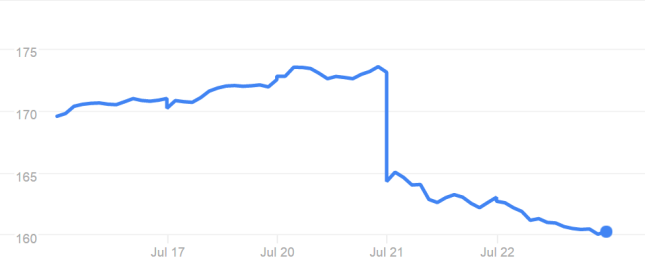

Cloud revenues were the positive highlight of Microsoft’s earnings dominated by the company posting a $2.1B loss from the Nokia acquisition. Commercial cloud ARR grew 88% (or 96% in constant currency) to $8 billion. This continues strong sequential performance from two quarters ago ($5.5 billion) from last quarter ($6.3 billion) to this quarter. These numbers prove that the investments in the unique combination of Office365, Azure and CRM Online is producing strong results.

Devices and search were other areas of improvement. Surface revenues grew 117% which contrasts with the poor IPad sales numbers disclosed by Apple. Bing also exhibited strong growth with a market share that now reaches 22%.

In summary, Microsoft earnings shows strong performance in strategic areas such as cloud, devices with a strong presence in the enterprise. These news have to be encouraging in anticipation to the Windows 10 launch next quarter.

IBM: Too Much Legacy

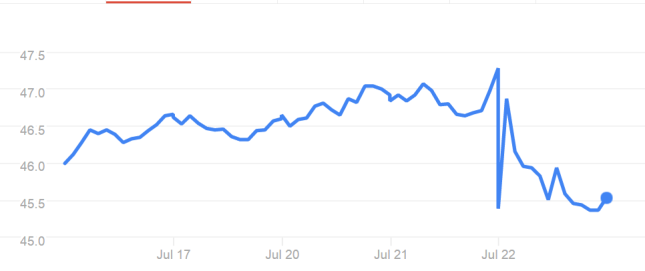

IBM earnings report resulted in the 13 consecutive quarter of revenue declines. Even though the company repeated the message about its current cloud transformation process, it couldn’t avoid missing revenue estimates. Revenue was down 13% affected by the strong dollar and net income was down 15%.

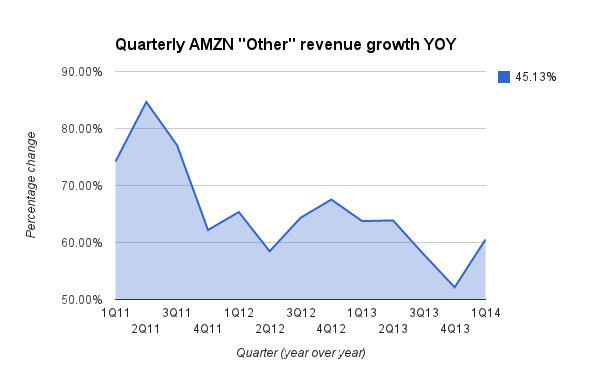

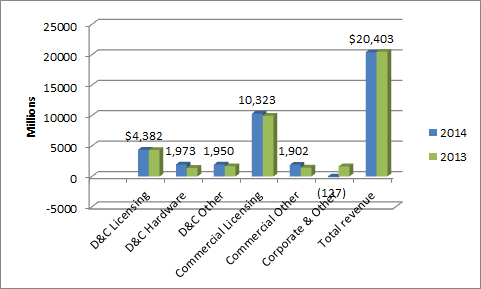

Similar to Microsoft, IBM reported strong growth in strategic areas such as cloud and analytics. Growth in those two areas came in at more than 20% while software revenues overall were down 10% for the quarter at $5.8 billion and down 3% adjusted for foreign currencies, while middleware was down 7% and essentially flat when adjusted for currency.

In summary, IBM is also exhibiting strong growth in strategic initiatives but the not enough to offset the decline of traditional businesses such as hardware or professional services. From that perspective, it seems that IBM has a long road ahead in its transformation processes.